This AI Startup Raised $18 Million To Take On NetSuite

Two-year-old Doss has reached $1 million in ARR by using AI to radically speed up its sales process. Now it’s raised a Series A from Tomasz Tunguz's Theory Ventures to level up.

Wiley Jones is a rare Silicon Valley entrepreneur who doesn’t do much business selling to his fellow software startups. “Our customers are a peanut-butter company and someone who makes cosmetics,” he says. “Someone else manufactures walls.”

That’s because Jones’ startup, Doss, is taking on one of the least cool – and biggest – categories in software: enterprise resource planning, or ERP. If customer relationship management, or CRM, is the brain of a business’ software back-end for selling pretty much any kind of goods, the ERP is its heart – where accounting and procurement live, inventory and financial planning.

Between the bean-counting software and the bean-selling customers (one of Doss’s marquee customers, coffee brand Kahawa 1893, literally does), startups haven’t historically made much inroads on the leaders in ERP software. Germany-based SAP was founded in 1972; U.K.-based Sage in 1981. NetSuite, the U.S. business acquired by Oracle for about $9 billion, by comparison is a spring chicken, founded as recently as 1998.

“This is an endlessly massive and unraveling problem that hasn’t been innovated since then,” Jones tells Upstarts. “The incumbents are all older than the average person at our company.”

For Jones, 30, and his team of about 20 employees to be the ones to change that requires some optimistic projection. Doss currently works with more than 30 customers and has reached $1 million in annual recurring revenue; NetSuite reported cloud ERP sales of $900 million last fiscal quarter alone.

But through the software capabilities afforded by artificial intelligence, Doss has early momentum. The startup recently raised $18 million in a Series A round led by investor Tomasz Tunguz of Theory Ventures.

Upstarts estimates that Doss is likely valued at about $75 million following the round; Doss declined to comment on its valuation.

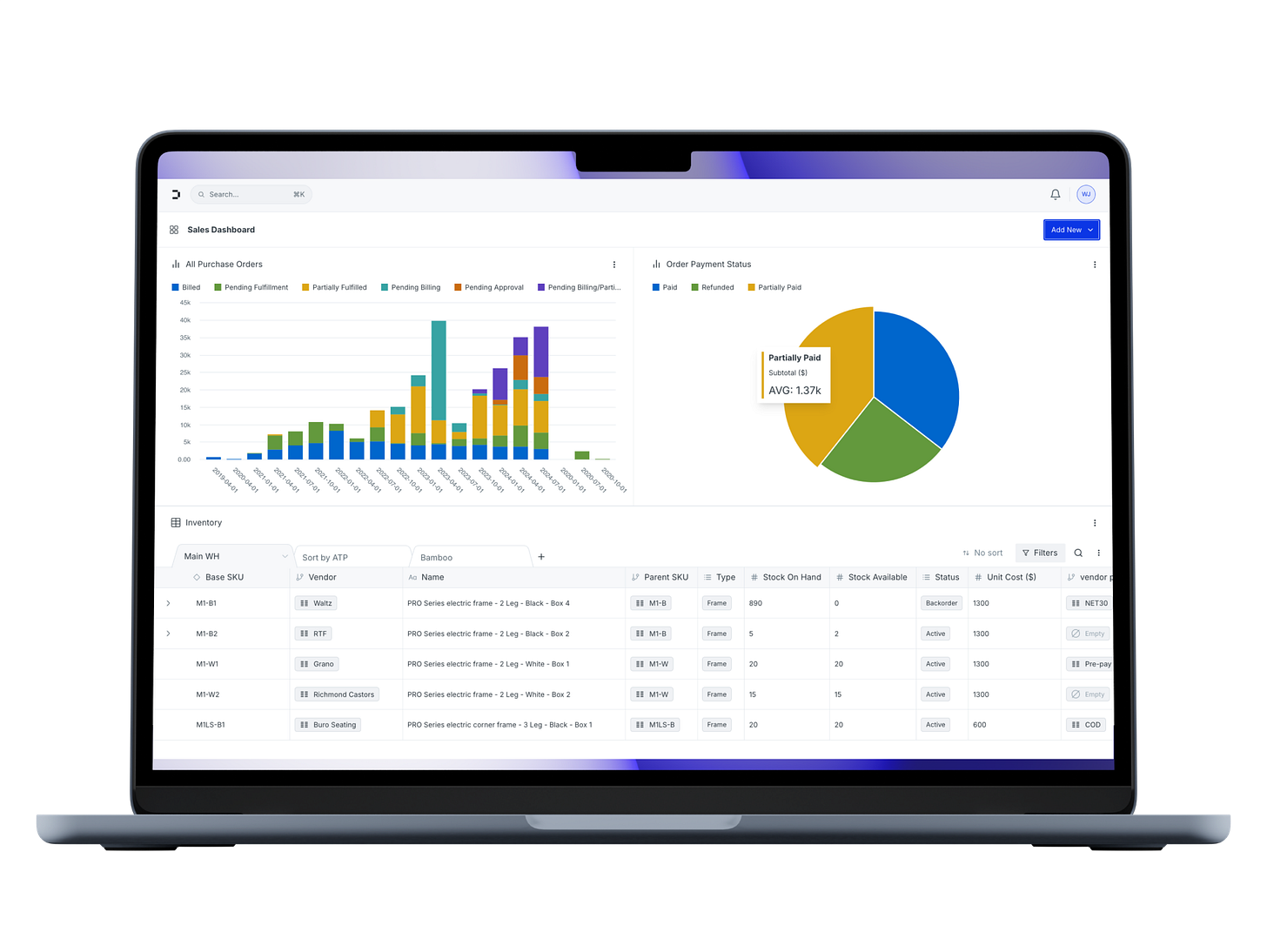

“We have all that stuff where you can hit Command-K and chat with an AI bot, and it’s useful,” says Jones, Doss’ cofounder and CEO. “But the real magic is what we have underneath our platform, almost its own programming language that can compile down our whole application for a customer, and build itself back up.”

Presented by our Launch Partner, Brex.

Founders were born to build, not to juggle spreadsheets and bank accounts. That’s why 1 in 3 US startups trust Brex to eliminate finance busywork and help them grow faster. Built by founders for founders, Brex’s financial stack maximizes your two most valuable resources: your time and money. Get up to 20x higher card limits, built-in expense management, and high-yield banking with 100% liquidity — everything you need to increase your runway and stay in founder mode. And because Brex scales from idea to IPO, you’ll spend smarter and move faster at every stage. Get started at brex.com.

Social-impact minded coffee business Kahawa 1893, which sells beans sourced from women producers in retailers like Trader Joe’s and Target, was at an ERP software “inflection point” in late 2023 when Doss reached out.

After years of stitching together purchase orders, wholesaler contracts and inventory in an Airtable database that required constant attention, Kahawa 1893’s vice president of revenue and operations, Corey Stary, faced the choice of either spending a lot of money to hire developers to beef up its Airtable system, or springing for an annual contract with Sage, Netsuite or another longtime player, Brightpearl, and committing to an onboarding process that would run six months.

To Stary’s surprise, when he took a discovery call with Doss, Jones, the CEO, personally led the demo and discussion. He stayed involved as Doss turned around a minimum viable product, or MVP, to demonstrate its value within the next several weeks.

“Every person besides Wiley we interacted with at Doss was in engineering or product. If I went to another startup, there’s a good likelihood that we would’ve ended up talking to somebody on their go-to market team, which is okay, but could lead to the over-promise, under-deliver dynamic that plagues certain startups,” Stary says. “Doss seemed ready to move quickly. Which was music to my ears, because I needed to move quickly.”

That speed to value, more than any technological secret sauce, is what has made Doss so promising, says Theory Ventures’ Tunguz, its new lead investor. Doss is an example of a thesis Tunguz, a longtime popular blogger in business software circles, calls “composable software” – software that can be developed faster, and adapted dynamically, using AI’s coding and technical abilities.

“Companies can put together Lego blocks of components to match what they need,” Tunguz says. “AI enables Doss to sell its product in a way that doesn’t look like any other ERP.”

For Jones, that was the hope when he cofounded Doss with CTO Arnav Mishra in 2022. In a career that included an eye-opening stay in China and hardware engineering roles at startups including Verkada and Athelas, where he briefly served as head of product, Jones says he had to work on the periphery of many of the ERP systems he’s now trying to challenge.

“You had to change what your business did in order to meet the application,” not the other way around. “I was pretty resigned to the fact that that’s just how it worked.” Watching a demo of OpenAI’s GPT-3 large language model in 2022 – the user was writing SQL database queries for pulling NBA player stats, Jones thinks – it all clicked, he says now.

Each wave of technology – the mainframe, PCs and the cloud – had its own wave of ERP tools. With AI, the process of working with systems integrators and services consultants to spend months onboarding a new system could be cut to one-tenth the cost.

But companies are loath to rip out an ERP. Choosing one that doesn’t work can cost a business millions of dollars and a chief financial officer their job. So Doss’s challenge is to get a customer into a call like the one with Kahawa 1893. Then, it can run a live demo version of its solution with the customer’s information, making changes in real-time.

It’s a race-to-value that the startup has leaned into after studying data analytics startup Looker, another Tunguz portfolio company that was acquired by Google for $2.6 billion in 2020. “When you show someone this magical thing in front of their face that defies their expectations, they’ll say, ‘Okay, I need that, how do I get it?’” says Jones.

Doss tries to know as much as it can about a customer before that first meeting; three full-time employees, working in the office together in San Francisco, handle the implementation sprint.

For another customer, Iggy Alvarez, an operations consultant working with Doss on behalf of dental brand Snow Cosmetics, says the onboarding process could do with some polishing once a customer’s up and running. But he still had his own magic moment when he was able to pull the minimum order quantity of a specific product based on its sales, without needing to write a pivot table or generate a report.

“Their secret sauce is how adaptive the reporting is,” Alvarez says. “It’s cliche, but you feel like you’re spending more time in the business.”

Asked how much a customer saves per year using Doss, Jones claims it’s hard to quantify “opportunity cost,” but that a business might save thousands of aggregate work hours per year.

“We need to do everything faster, better and more effectively.”

The bigger the customer, the more likely it already works with an ERP provider, meaning Doss faces an uphill battle to rip someone else out. On the flip side, that means companies that do commit to Doss are more likely to remain loyal.

With contracts ranging from $10,000 annually into the hundreds of thousands, Doss plays in the mid-market of companies between $5 million and $200 million in sales. That’s where a number of other startups operate, the oldest and arguably most notable being Odoo, a Belgium-based, open-source alternative to SAP that has been in the market since 2002. Odoo claims five million users and raised 500 million Euros last year. A number of other smaller startups raised rounds over the past year as well, including Cogna, Nominal, Rillet and Keel.

If Doss wants to move up-market to compete with SAP, it will also likely come across mysterious startup Everest Systems, a German-based venture led by former longtime SAP executives. Everest has raised $140 million from a number of investors, per PitchBook, and announced its product and funding in a blog post about four months ago; the post was later taken offline, and a spokesperson couldn’t be reached for comment on Monday.

In a land grab on all sides, perhaps Everest is mindful of copycats – it’s something Doss could worry about, too. Asked how he’ll keep Doss’ software a step ahead of the tech giants, its CEO says he’s counting on Clay Christensen’s ‘Innovator’s Dilemma’ to provide a shield: the incumbents can’t emulate Doss’s approach without undermining their own channel partners and integrators, he argues.

As for all of those startups chasing the same prize (the above are just a sample), Jones has a simple response: with its new funding, Doss will need to hire aggressively on its prospecting and implementation teams – and work around the clock.

“We need to do everything faster, better and more effectively,” he says.